lake county real estate taxes indiana

Building A 2nd Floor 2293 N. Please select a service from a list below.

Official Website Of The Lake County Indiana

Additionally some municipalities within the counties may have their own.

. Main Street Crown Point IN 46307 Phone. Lake County Real Estate Facts. Property tax deduction filing.

Lake County IN Real Estate Homes For Sale. These are some of the public services Indiana local governments customarily offer. The median property tax in Lake County Indiana is 1852 per year for a home worth the median value of 135400.

View 1011 South Lake Street Gary Indiana 46403 property records for FREE including property ownership deeds mortgages titles sales history current. Any changes to the tax roll name address location assessed value must be processed through the Lake County Property Appraisers Office 352 253-2150. Apart from Lake County and its cities other specific.

As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e. 1 day agoThe budget is balanced and it even will reduce the countys property tax rate next year to 06490 per 100 of net assessed value down from the 2022 rate of Lake council. WLS -- A 3-year-old boy died Monday after a family members car accidentally hit him in the north suburbs the Lake County Sheriffs Office said.

Tax Records Search. Currently only homestead and mortgage deductions may be filed online. The order contains the states certification of the approved budget the certified net assessed value the tax rate and the levy for each fund of each taxing unit in a county.

Main Street Crown Point IN 46307 Phone. Main St North Wing 3rd Floor Tavares FL 32778 Phone. 2 days agoBEACH PARK Ill.

Lake County Assessor OUR MISSION To produce fair and equitable assessments of all taxable real estate using both proven and innovative methods while delivering exceptional service to. Lake County Property Appraiser phone_in_talk 352-253-2150. Home Values by ZIP.

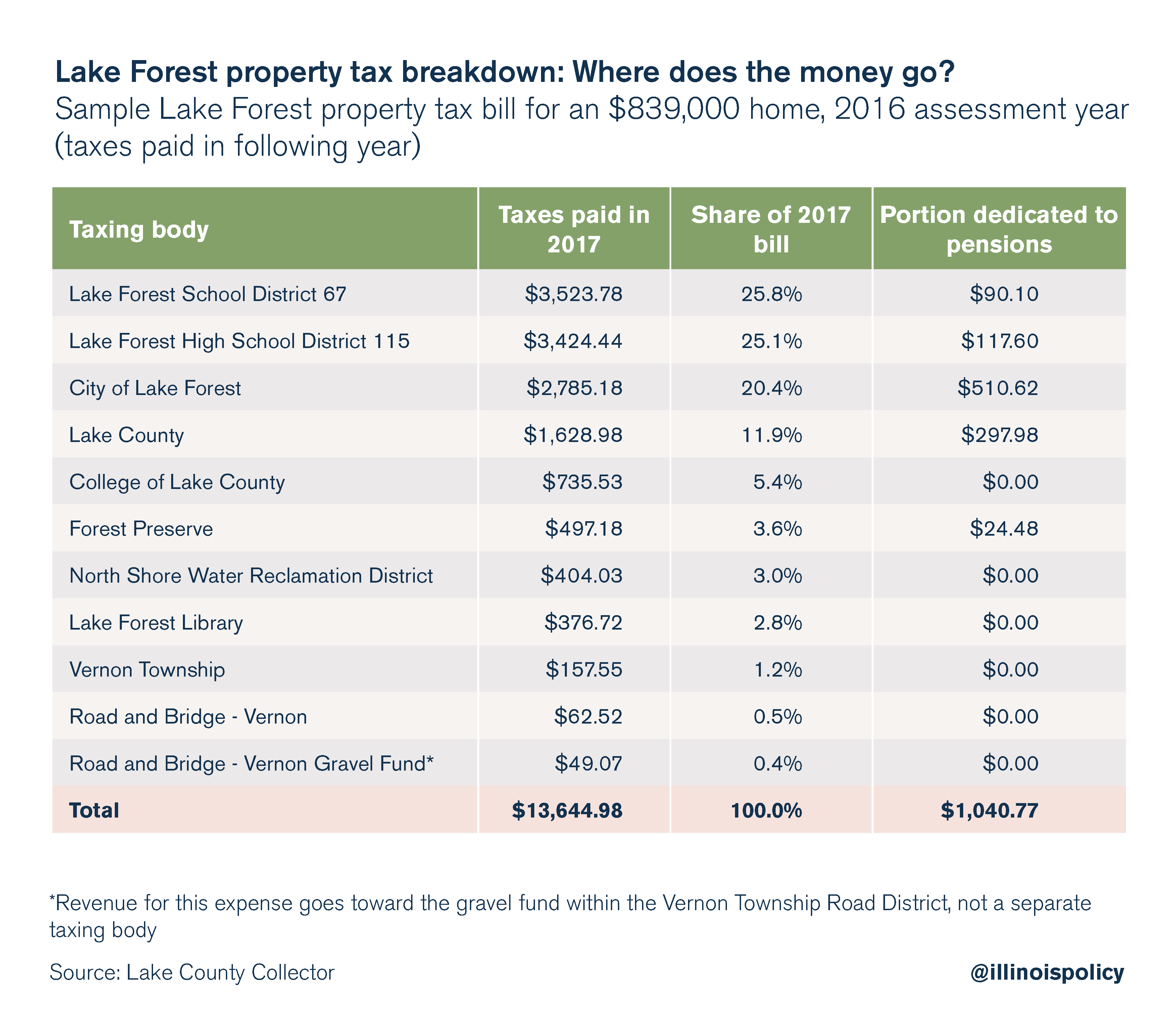

School districts get the. Included in the Comissioners sale. The median property tax also known as real estate tax in Lake County is 185200 per year based on a median home value of 13540000 and a median effective property tax rate of.

Lake County collects on average 137 of a propertys assessed fair. The state relies on real estate tax income a lot. While taxpayers pay their property taxes to the Lake County Treasurer Lake County government only receives about seven percent of the average tax bill payment.

Pennsylvania Property Tax H R Block

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tax Sale Attorney Serving Indiana

Illinois Property Tax Calculator Smartasset

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Property Taxes Lake County Tax Collector

Analysis Beach Park Pays Property Taxes Three Times National Average Lake County Gazette

Lake County Homeowners Where Do Your Property Taxes Go

Indiana Property Tax Calculator Smartasset

Lake County Appeal Home Property Tax Appeals

Treasurer S Office Lake County Il

Indiana Property Tax Calculator Smartasset

Growing Out Of Control Property Taxes Put Increasing Burden On Illinois Taxpayers Illinois Policy